Mobile Look at Deposit: What is it and how does casino Foxy login it works?

The financial institution conserves money when you put a via your cellular telephone. And in casino Foxy login most cases, your own financial won’t charge you for making use of this specific service. I wear’t know about you, however the last thing I wish to do immediately after a long week is sit in a bank line for 20 otherwise 29 minutes. To the a monday afternoon, all you have to should be to go homeward and luxuriate in the weekend. But if it’s pay check and your workplace doesn’t render lead deposit, you’ll need to make a visit to the bank. Personally, it has been from the a-year since i’ve accomplished a lender transaction on the reception.

Casino Foxy login | Put charge

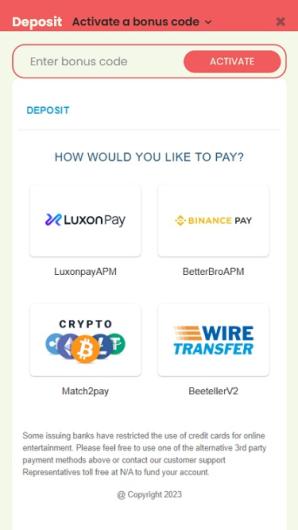

Mobile consider places could be rejected on account of mismatches involving the check’s information and you can member-provided facts, such incorrect numbers or unreadable signatures. Sure, spend from the handheld tool casinos is definitely judge from the Joined Empire since it is managed from the Uk Playing Percentage. And make repayments from the phone is simply other form of spend utilizing your cellphone.

Mobile deposit

If it goes you ought to block they along with your provider and whenever possible, inform your internet casino so you can stop people deposits if you do not find they or and obtain a new mobile phone. Swift Gambling enterprise existence as much as its identity since the a speedy cellular deposit casino you to definitely kits players to the action rapidly. Integrating which have major cellular payment company to help you energy the deposit, Quick Gambling establishment processes such purchases quickly and you may charges her or him directly to their cellular phone statement.

Tech difficulties, including, could make it impossible to make use of your mobile look at deposit application if the truth be told there’s a problem. And you will be unable to have fun with cellular take a look at deposit in case your take a look at you should deposit is actually above the restriction welcome by the bank. If you believe cellular view put will be a very important banking ability, there are many facts to consider while using the they. Precisely endorsing a check for cellular deposit can aid in reducing the likelihood of the put’s being declined. You’ll want to go after such laws and regulations if you’re also preparing an individual view, an official consider otherwise a mobile deposit cashier’s view.

- Browse the Chase Vehicle Degree Cardio to find automobile information from a trusted source.

- You could link the eligible examining otherwise savings account in order to an account you have from the other bank.

- As soon as your mobile take a look at deposit clears, you may enjoy the money in your account.

- For many who don’t have in initial deposit slip, you can simply create your account amount for the consider.

- Alyssa Andreadis are an author with more than twenty five years away from selling experience which can be passionate about enabling family getting comfortable with money.

- Inside the today’s electronic years, transferring checks has become more convenient than ever, because of the development of mobile financial innovation.

However, keep in mind that particular providers such Meters-Pesa allow it to be users to pay for the accounts through ATMs, agencies or which have discount coupons. I encourage brokers which have reducing-edge security measures such a couple-basis authentication and you will biometric ID, as well as good privacy steps including SSL encoding. You need to be in a position to rely on the newest broker your’re animated your finances to help you, so believe try all of our priority whenever we price change systems and it also might be your, as well.

Credit cards

Be prepared to give them away with your ID, debit cards, deposit sneak, and you can endorsed take a look at. Let the teller know the way far you need to put and you can if or not you need any money straight back. Zero, the newest gaming site is not going to charge a fee for buying and make places playing with spend from the cellular slots. The brand new gambling establishment is not in charge if your phone company charge a good negligible number. If the app means difficulty, you’ll want to look at the techniques once more. It’s a smart idea to store they for several of weeks, and when anything has to be affirmed.

All of our people usually do not pay us to make certain advantageous analysis of the products or services. Morgan Wealth Administration Part or listed below are some our very own current on line spending have. Just like a classic put, there’s always the possibility you to definitely a can get bounce. To be sure the money is actually transferred truthfully, it’s wise to keep hold of your own inspections before deposit have cleaned. That way, you’ve got the check on submit situation anything goes wrong during that time. Rebecca River try an authorized educator inside individual money (CEPF) and you can a financial expert.

Make sure you generate ‘mobile consider put’ and also the go out to your front side of one’s consider, and you may help save it to possess ninety days. Promoting a check and you may and make a mobile view put try apparently easy steps. Mobile financial software make the procedure smoother having action-by-step instructions and information when taking photos of one’s look at. Simply follow their bank’s tips and make a profitable put. As soon as your cellular take a look at put clears, you may enjoy the money in your account. Wells Fargo imposes each day and you will monthly limitations on the overall buck number of view dumps you can make thru cellular put.

Their bank’s mobile consider put contract have a tendency to outline the kinds of checks you happen to be permitted to put. Speak to your supplier to own specifics of particular costs and charges. If you receive an error message, take some time to make sure your’ve recommended the fresh look at, signed the name, and you will verified the fresh deposit amount and you can account facts. Should your put demand still doesn’t go through, you may also imagine reaching out to your financial organization to possess direction.

If you would like so you can speed up their salary dumps, you could potentially benefit from direct deposit. This enables your boss to deposit fund in to their lender membership instead that gives a newspaper take a look at. To set up a direct put, it is possible to generally must ask your boss to possess a primary put form, complete it along with your account information, and you can fill in the fresh done form back into your boss.

You’ll capture images of one’s look at inside application and you may enter view suggestions, for instance the count, to do the put. Financial institutions usually inform you through your chose method (email, text message, push notification) that your particular mobile view put is handling. They’re going to in addition to usually let you know if look at could have been canned. Cellular banks found defense against the fresh FDIC to protect the dumps. Just make sure you employ fundamental web sites security techniques to safeguard the passwords and you can analysis. Which have a cellular banking software, you could do all those employment from anywhere, greatly simplifying the whole process of controlling your money.

Immediately after logging on the bank’s cellular app, users can also be discover mobile deposit alternative, capture a very clear photograph of the front and back of your take a look at, go into the count, and fill in the brand new put. The new app usually will bring instant confirmation, plus the finance are available within this a business date. The fresh cellular take a look at put processes makes you complete your own checks playing with a capsule otherwise mobile each time, almost anyplace.

Placing monitors utilizing your mobile device is generally more accessible and you will a shorter time-sipping than just riding to a branch or Atm. Just in case your lender having an on-line-only lender with no physical branches, cellular consider deposit could be reduced than simply emailing in the a check. Should your lender plans to lay a hang on the new put, you can even discover an alerts ahead of signing a mobile view put. You’d following have the option to continue on the cellular deposit and take the fresh consider to a department rather.